Why Every Growing Business Needs a Solid Cash Flow Strategy

When human beings talk about business fulfillment, they regularly mention income margins, sales figures, or patron growth. But there’s another, often omitted, detail that definitely determines whether or not an enterprise prospers or struggles—cash drift. Simply positioned, cash glide is the movement of cash inside and outside of your enterprise. It’s what will pay your payments, continue your operations, and fuel destiny expansion.

Without a proper coin drift strategy, even worthwhile organisations can find themselves in a problem. A corporation may have notable sales on paper, however, still struggles to pay salaries or providers if cash doesn’t go with the flow in time. For growing groups, where expenses upward thrust and operations expand, coping with cash flow isn’t optional—it’s crucial.

Understanding Cash Flow Beyond Profit

It’s smooth to count on that if your enterprise is profitable, your cash flow ought to be healthy too. Unfortunately, that’s now not usually authentic. Profit represents what’s left after deducting expenses from sales; however, cash float reflects the actual liquidity—how many coins your business clearly has to paint with. A commercial enterprise would possibly record income while still running out of cash because those profits are tied up in unpaid invoices or long-term assets. This is where the monetary management guide becomes priceless. For example, agencies that rely upon Outsourced Accounting in New York often benefit from better visibility into their price range and gain from professional forecasting and reporting. Such partnerships help growing firms pick out coin shortages early and preserve monetary stability even at some stage in rapid growth.

Why a Solid Cash Flow Strategy Is Essential for Growth

Every successful commercial enterprise growth requires cautious planning. A well-described coin glide method allows groups to grow without risking their financial foundation. By predicting how cash moves through the commercial enterprise, leaders can make smarter decisions approximately hiring, buying, and investing.

When your commercial enterprise is scaling, prices often come before revenue—new hires, advertising and marketing campaignsy, and infrastructure prices all call for premature spending. Without a clear coin drift plan, those fees can quickly drain your reserves. That’s why setting up monthly or quarterly coins drift forecasts can assist in predicting capacity shortfalls.

Moreover, a sturdy approach permits flexibility. When you understand what to anticipate, you may plan for slower months, allocate reserves, and avoid last-minute borrowing that ends in high-interest debt.

Key Components of an Effective Cash Flow Strategy

A strong coin’s go with the flow plan isn’t about good fortune—it’s about structure. It’s built around 3 key pillars that each enterprise owner ought to grasp:

Cash Inflow Management

Focus on improving how your business gets cash. Set clean fee terms, comply with invoices directly, and bear in mind supplying discounts for early bills.

Cash Outflow Control

Keep a close eye on prices. Avoid pointless spending and negotiate higher charge terms with providers. Tracking where your money is going guarantees that every fee aligns with your commercial enterprise goals.

Forecasting and Monitoring

Use economic dashboards and accounting gear to display developments. Regular coins go with the flow; forecasts help you expect demanding situations before they arise. They additionally permit you to put together backup plans if income slows down abruptly.

When groups put into effect those three steps continuously, they hold a constant float of cash and benefit from the confidence to increase sustainably.

The Role of Financial Planning in Sustaining Cash Flow

A proper cash flow method doesn’t work in isolation—it’s part of a broader financial plan. Long-term economic balance relies on balancing short-term liquidity with destiny investments and increase. This is where expert steerage could make a large difference.

Partnering with a professional Accounting Firm in Oman can help organisations structure their budgets and align cash management practices with their typical desires. These firms regularly convey insight throughout industries, helping clients forecast seasonal fluctuations, manage dealer payments, and prepare for sudden market shifts. Financial planning guarantees that your coins flow with the flow, helping—not limiting—your organisation’s ambitions. It affords the clarity to make assured decisions about hiring, scaling, or launching new products whilst preserving your enterprise’s financial soundness.

Common Cash Flow Mistakes Growing Businesses Make

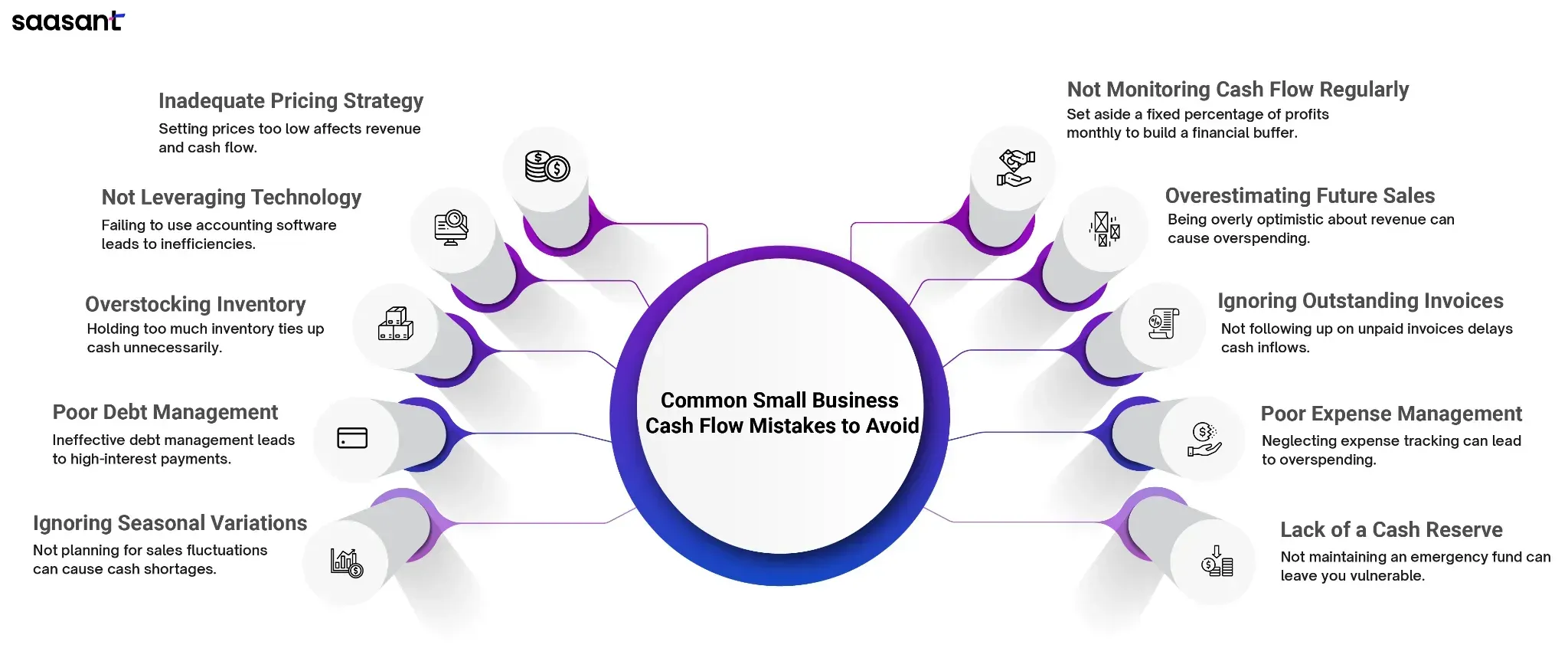

Even thriving agencies can make simple errors that harm their coins. Some of the maximum not common ones include

Overestimating revenue – assuming that sales will constantly rise can result in overspending.

Underestimating expenses – ignoring small charges that add up over time.

Expanding too fast – fast scaling without enough capital reserves can choke liquidity.

Relying on one or two customers – depending too closely on confined earnings assets will increase financial vulnerability.

To avoid these pitfalls, it’s important to hold accurate monetary data, evaluate regularly, and plan for the unexpected. Growth ought to be a slow manner supported by stable cash management now not a jump of religion.

How a Solid Cash Flow Strategy Fuels Long-Term Success

Strong cash flow isn’t just about paying payments—it’s a possibility. An agency with consistent liquidity can reinvest in its operations, rent new talent, and discover innovative initiatives without economic stress. Positive coin floats also strengthen relationships with suppliers and buyers. When your finances are dependable, you benefit credibility, better credit score phrases, and less complicated get right of entry to investment. Over time, those blessings create a cycle of sustainable boom. In assessment, bad cash drift can lure groups into survival mode—continuously juggling payments and delaying strategic decisions. The difference between the 2 frequently comes all the way down to making plans. A robust method transforms uncertainty into control and turns ambition into potential results.

Conclusion: Building a Future-Proof Business

Cash float is the silent pressure that powers every developing enterprise. While income would possibly entice interest, it’s steady liquidity that determines lengthy-time period survival and fulfilment. Managing cash efficiently isn’t pretty much fending off crises—it’s about growing a real business to grow expectantly. Every entrepreneur should view cash flow as a commitment. View your forecasts regularly, live on top of prices, and be proactive rather than reactive. Whether you’re a startup locating your footing or a longtime commercial enterprise expanding into new markets, a strong coin drift strategy is your basis for sustainable fulfillment.